First part in a collection of papers being produced by SIC on the transition to independence. Full document and further reading here.

“We must think of self-governing Scotland as an independent legal jurisdiction which has internationally recognised legal boundaries. A Customs officer at an immobile Customs Station, in an open-borders 21st Century European community, has very little impact and demonstrates how Unionists miss the point, whilst further; successfully confusing our electorate by claiming “hard borders” are a show-stopper when in fact they are very largely irrelevant.”

1 Introduction and Background

This paper is written at the invitation of Scottish Independence Convention. The author’s practitioner and academic experience spans 40 years across customs & excise, borders, revenues, and defence, in the UK and internationally. Its purpose is to outline key ‘borders’ issues that should be considered by a transitional Scottish Government following a vote in favour of independence in order to collect and protect our future revenues and society.

This paper focuses on systemic failures in the current UK system and how these should be avoided by an independent Scotland; outlining some of the approaches we could take to provide a more effective customs and borders policy that benefits Scotland.

It is the author’s professional opinion that HMG mis-management of UK borders is contrived in order to reduce revenue payment and collection by global corporations. A University of Birmingham paper evidenced that Her Majesty’s Government (HMG) decision making was, “ideological coherence as a belated application of market-inspired techniques to the tax authorities.”

2 Borders and Customs

Borders have always been synonymous with collecting import and export revenues. Such revenues however, are only one important cog within the national revenues wheel, and cannot exist in isolation within an Edinburgh revenue strategy. The question arises as to what the role of a Customs Officer is? In short, they are empowered, by Statute, as a law enforcement officer, to collect and protect national revenues and enforce Customs and other related laws. The World Customs Organisation (WCO) and World Trade Organisation (WTO) recognise this role within trade facilitation and revenue collection.

Some imports have Value Added Tax (VAT) levied on them. On arrival in the UK, EU imports are normally collected and accounted for by VAT registered UK importers and verified through periodic VAT Returns, submitted to HMRC. Import Excise duty, on fuels, alcohol, tobacco products etc. is collected by Excise registered traders, and again the appropriate revenue returns submitted to HMRC. Revenues are collected at the time when the transaction takes place; not at the border. Non-EU imports may also attract VAT and Customs import duties and levied according to UK Tariff at the time, payable on arrival at the point of import.

2.1 UK System: Dysfunctional and Leaking Revenue

So, how much import and export revenues does Scotland generate annually? In short, we don’t know and provides another benefit of controlling our own system. No statistical data is collated for Scotland as a discrete geographical area. All three UK Government agencies, responsible for the collection of Excise Duty: HMRC, UK Border Force (UKBF) or Office for National Statistics (ONS), only produce data for the UK as a whole.

2.1.1 Dysfunctional

This highlights the current dysfunctionality of the UK system for excise duty collection. Her Majesty’s Revenue & Customs (HMRC), reporting to HM Treasury, is not located at UK borders but situated at various inland locations. Relevant Treasury departments are responsible for International Customs services and are located at ports and airports. As is the UK Border Force (UKBF); the principal department at ports, airports etc. and responsible to The Home Office. With 90% of their work focused on anti-immigration initiatives, revenue protection and collection tends to be of secondary consideration, again evidencing the UK dysfunctionality in this area. Borders controlled by an Independent Scotland can do more than this and ensure that due tax is paid and product and services standards are maintained.

In spite of a damning report by the Independent Chief Inspector of Borders and Immigration (ICIBI), carried out between March and July 2013 and published November 2013, HMRC and the Home Office entered into a partnership agreement allowing the Border Force to operate customs controls from 1st January 2016 until 31st December 2018.This included powers for collecting and protecting customs revenue functions and anti-smuggling, in spite of Border Force reporting directly to the Home Office on a customs and excise role (typically a Treasury agency function), highlighting an utterly incongruous and inefficient system. A Written Parliamentary Question (WPQ) is currently asking have these two organisations been working unlawfully or illegally since 1 Jan 2019.

Incredibly, very few UKBF officers are empowered, by law, to carry out customs tasks. Interestingly, Para 1.3 of the “Partnership Agreement”, itself now out-of-date legislation, recognises the importance of UKBF staff being empowered, by law, as “Customs Officials”. It is difficult to find a better example of inadequate UK governance that exposes the UK assertion that “Customs” are collected at the border. What does this mean for the Scottish case? In Scotland, there appears to be no evidence that any attempt to combat smuggling is happening. The issue of borders legal primacy is dealt with below.

Consequently, further evidence of poor governance is that HMG has been carrying out illegal practices for the last 18 months. At tactical level; no empowered Customs Officials and, at operational/strategic level; no partnership legislation.

The “Customs” service, consistently being referred to in Westminster documents pertaining to Brexit, no longer exists despite Customs import revenue controls being carried out. There have been no Customs Officers at Glasgow or Edinburgh since 2005.For the reasons set out above, it is the UK Border Force immigration service that staffs ports and airports, not Customs and Excise. HMRC and UKBF have been shedding staff and closing offices since 2005. At Independence, a new Scottish Government would expect to be allocated Scotland’s Customs Service Officials and staff as well as the existing infrastructure within the UK system at the time of Independence. HMRC and the UK Border Force however, have been shedding staff and closing offices since 2005. The Scottish Government White Paper, Scotland’s Future 2014, suggests replication of this broken, ineffective system, mirroring the current UK taxation regime: this should be avoided.

So, what have we established so far? The UK approach is characterised by nebulous Brexit Borders/Customs controls with zero evidence of resources to cope with the tsunami of import/export transactions and attendant delays due on 1 January 2021.

2.1.2 Leaking Revenue

Taken together, this is an appalling example of poor governance leading to endemic revenue smuggling. For example, currently tobacco smuggling alone is estimated to reduce HMG revenues annually by £2.2 billion. Scotch whisky fraud amounts to estimated £40 million trade comprising of fake whisky and unknown quantities of False Exports i.e. whisky declared as duty-free for export but illegally diverted onto the UK home market…Constantly changing UK priorities, such as the current focus on anti-immigration measures, ensure reduced HMRC staffing capacity in Scotland and reduced intelligence resources, leading to an increasing inability to detect revenue fraud allowing and encouraging widespread organised crime.

In 2005, the Labour chancellor, Gordon Brown, amalgamated HMCE with HM Inland Revenue to form HMRC. He did this shortly after the USA had carried out a similar exercise with the US Customs Service, changing its name into the Bureau of Customs and Border Protection. This was a reaction to 9/11 attacks and the revelation that US agencies were not sharing information on intelligence which may have prevented the attack. An unintentional effect however, was to significantly reduce revenue protection and help facilitate multinational corruption. Indeed, corruption is alleged at the heart of HMG/HMRC decision making. The proof is in UK endemic, institutionalised tax avoidance and evasion.

Indeed, the paper “Accounting for Merger: The Case of HM Revenue and Customs” (2010) 13pp identified that:

“The New Institutional Sociology (NIS) inspired explanation, however, may view the merger with varying degrees of suspicion. According to this viewpoint the basic reason for merger will be located in the New Public Management (NPM) inspired mimetic (i.e. following others) and normative (i.e. following the norm) pressures upon the government. The repeated references to Canadian [and USA] experience of merger and other OECD countries in the TSC reports and official publications can be cited as evidence of mimetic and normative pressures upon the government to follow the path of isomorphism”

In 2017, the notorious American neo-con, Steve Bannon, crystallised these ongoing moves as the:“destruction of the administrative state… meaning a system of taxes, regulations and trade pacts that the president and his advisers believe stymie economic growth and infringe upon one’s sovereignty”. It is unlikely that an Independent Scotland would want to focus its approach to taxation and public services on this view, one unfortunately supported by Boris Johnson and the Westminster government

3 Key Future Issues

This paper contends that the London business elites have zero intention of having import freight controls at Dover, the Irish border or anywhere else in the UK and have every intention of exploiting the UK’s offshore location with Europe as a low tax haven with few labour laws. Reducing import revenues for big business and corporations require increases elsewhere to make up for the resulting massive shortfall in government revenues, this means even further Austerity measures. Personal income tax and VAT rises on everyday essentials, such as fuel and, goods and services will be necessary to fund the already under-resourced NHS and other public services. In other words failure to collect customs revenue from large corporations means the public have to make up the loss in taxation.

3.1 Where will our future revenues come from?

Wealth generated in Scotland and worldwide, by the People of Scotland and traders within Scottish jurisdiction including multinational corporations. Wealth produced as a result of Commonweal’s Resilient Economy Initiative would be an excellent starting point to consider the “when, how and why?” of the nation’s revenues and is important within the context of reducing traditional revenue sources such as: carbon fuels, tobaccos, alcohol and other lifestyle choices. Customs legislation should be flexible enough to implement a modern, progressive Scottish Revenue policy which hopefully will be very different in comparison to Westminster neo-conservative economic system.

3.2 What would the implementation costs be?

Currently, HMRC estimate 1p in every £ GBP collected, plus a further £10 million + per annum collected by every staff member. The clear logic is to maintain these ratios and employ more staff in order to increase the overall revenue yield.” Customs Officers should be strategically located across the country, with a substantial maritime presence. A draft estimate for this division suggests a fully effective team would have 800 officers, each are capable of bringing in as much as 100 times their salary in tax revenue. A Customs [Service] of this kind could be responsible for over half of Scottish revenue collection”. Every professionally trained Customs Officer could be given Key Performance Indicators (KPIs), as part of their management plans, to raise many times their staff costs per annum and this must be a national priority. The UK government is driving down staff numbers in spite of increasing billions of pounds in unrecovered revenues and using austerity as an excuse for poor outcomes. 30,000 officers from HMRC have been removed since 2005, 30,000 officer numbers have been cut from the HMRC workforce. For Scotland to follow the same path as UK revenue collection, would be a great mistake.

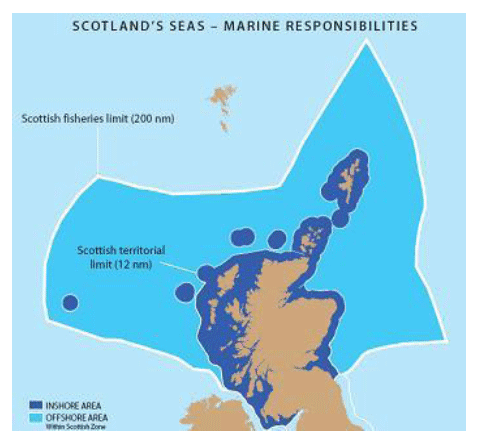

Immediately, a potential dichotomy becomes apparent. Revenues jurisdiction within Scotland is clearly not only a land border issue. As a rule, naval vessels are responsible for deep or “blue water” enforcement while inshore or “brown water” enforcement is carried out by custom’s vessels, commonly referred to as “Cutters” currently; however, Scotland has no such vessels based in our ports. See Figure 1:

Figure 1: Scotland’s Seas

3.3 Smart not Hard Borders

Static border controls are easily evaded; they are the result of historical events and as such, in modern societies and in the light digital technologies, are outdated in protecting economies and raising revenues. Professor Hiroshi Motomura (UCLA) argues that there is a long established legal precedent for “functional borders”. A border can be conceptualised, according to his analysis; “not a fixed location but rather wherever a government chooses to perform border functions”. In that context the Unionist “Hard Border” is a misconception and a deliberate distraction. It focuses on a 150 kilometres stretch of land between the Solway and the Tweed and misrepresents reality; the coastline of metropolitan France is 3,500 kms while Scotland’s coastline, at high tide is 18,672 kms.

Additionally it may be argued that sensationalist, far-fetched attention, paid by the UK government and mainstream media, on imports crossing into Scotland which must combat barbed-wire, guard posts and bureaucratic, aggressive delay are also a “Hard-Border” diversion which completely misses the point. Scots exports are more of an important priority to our economy. The concept of functional or ‘smart borders’ means that up to 90% of national revenues and legislative controls can be carried out inland, within Scottish Jurisdiction.

To assist revenue collection, anti-smuggling controls would focus on “Intelligence Preparation of the Border” (IPB) within a modern Integrated Border Management intelligence-led analysis and risk system. The emphasis must be on mobile controls, in depth, covering the whole Customs jurisdiction of independent Scotland. The crucial aspect being the whole of Scotland is “borderland”, subject to Customs controls. Scottish Customs Officers could secure tax payments wherever they are due in Scotland, or abroad, within their legal powers and Statute of Limitations.

It cannot be over emphasised, the creation of a revenue department, including a Customs Service, would be a golden opportunity for Scotland. The economic stresses and hardships caused by the coming pandemic recession and a Hard Brexit could be mitigated by an independent Scotland creating a tax revenues system, built to meet the needs of the Scottish Economy and raising the revenues required to support and protect our communities.

Indeed, this paper attempts to create a vision of aspirations combined with actions, focusing on what we want to create in order to generate a vote-winning concept. To achieve this, the paper prioritises the following:-

4 Borders Jurisdiction

4.1 A Written Constitution

A Scottish Constitution must enshrine the concept of “Right Tax at the Right Time” to ensure tax compliance of every individual and trader within our jurisdiction liable to pay taxes. Fundamentally, fair and equitable collection of due revenues and taxes must be the guiding principle throughout. Revenues due by individuals, traders and multinational companies anywhere in Scotland must be paid correctly and on time to support government expenditure. Relevant income which is liable for tax must be calculated applying only Scottish Taxation Laws and regardless of any foreign directives for the calculation of taxable income.

4.2 Legal Primacy

Logically and for practical reasons, Customs must have legal primacy in jurisdictional matters pertaining to Scotland’s border and responsible for collection of all revenues payable within the jurisdiction of Scots Law. Customs must also be included in, “The Resilience Division” leading on emergency planning, response and recovery on behalf of the Scottish Government.”

4.3 Customs & Excise Laws:

See Annex A. The Scottish Government must establish a specialist team to assist in a review of such laws as soon as transition is implemented in order that they are, “…written in clear, modern and simple language to better facilitate their understanding by traders and the general public, as well as their consistent application by Customs personnel.”

4.4 Customs Service Legal Office

Scotland’s efforts to establish a fair and progressive taxation system can expect to be aggressively attacked in attempts to undermine them by Corporations, their Accountants and Economic Advisers and Lobbyists. In response, a dedicated team of Solicitors and Taxation Accountants, all highly motivated experts, should be established to reinforce and monitor the new statutory regulations. It is not unusual for fresh employment opportunities to arise in both the legal and accountancy professions, therefore contracts and working environments should be flexible enough to meet the needs of both the employer and the employee.

4.5 Education/Compliance

Organisations representing the interests of business and industry on taxation issues should be established and include businesses importing or exporting goods as part of their business model. It is fundamental to the success of the taxation system that the Customs Service facilitate open forums, to ensure as wide an acceptance of Government policy and ensuing legislation as possible.

In general, public and traders can be grouped using a “Traffic-Light” system; Green for compliant, Amber for non-compliant and Red for illegal. The optimum scenario would be for everyone to be categorised as Green, Customs compliant. In reality, there will always be a need to provide education and guidance to the non-compliant, Amber category; moving towards compliance and away from illegality. Constant, positive PR messaging is essential, showing tax payers and communities the benefits derived from the various forms of tax collection, whether through material examples, such as hospitals, schools or other public amenities or the public services carried out in them. Equally important, illegal fraudulent tax evasion, must be seen as deserving of punishment by law.

4.6 National Crime Agency (NCA)

It is accepted that Scotland should develop its own overarching agency. The current Westminster directed “Operational Priorities” are nebulous in character with no input into customs or revenue crimes. For clear economic reasons a transitional Scotland must prioritise protecting our customs revenues.

5 Governance

5.1 Strategy

Establish a transitional Scots shadow treasury team, working closely with the new National Investment Bank to plan, publish and implement a national taxation and revenues strategy. During the transition to self-government, it will be essential that Scotland develops a strategy to establish a sound foundation for good financial governance.

5.1.1 Revenue Collection

This paper strongly suggests utmost emphasis should be placed on establishing a robust system of revenue collection from Multinational Companies and other large business trading in Scotland. Current estimates suggest that in 2019, such businesses only contribute £84.7bn (11.7%) of UK national revenues compared to an EU/EFTA average of approximately 25% revenue contribution. Small and Medium Enterprises, as well as public taxpayers, must have confidence in the knowledge that the national tax burden is being shared more equitably than it has in the past. Customs strategy and the national revenues policy must complement each other.

5.1.2 Revenue Risk Analysis and Assessment

A Revenue Risk Analysis and Assessment team should be established. Former French Minister for Economy, Finance and Industry, Pierre Moscovici is quoted as saying, “Countries were free to set their own corporate tax rates, but highlighted international tax reform was needed. Let’s make no mistake: the headline rate is not what triggers tax evasion and aggressive tax planning. That comes from schemes that facilitate profit shifting”. Scotland must combat these schemes. One option being, “at country level, the corporate income tax base can be made largely inelastic by apportioning the global, consolidated profits of firms proportionally to where they make their sales…’ This would put an end to profit shifting because firms cannot affect the location of their customers (they can’t move their customers to Bermuda) and if they try to pretend that they make a disproportionate fraction of their sales to low-tax places then this form of tax avoidance is easy to detect and to apply anti-abuse rules. This would also put an end to competition for real activity, because in such a system there is no incentive for firms to move capital or labour to low-tax places; the location of production becomes irrelevant for tax purposes”.

5.1.3 Multimodal

The Scottish Government must prioritise investing in and developing a modern logistics strategy and transport infrastructure making Scotland an effective and attractive trading location. Necessarily, this would have to focus on a holistic approach encompassing sea, air, road and rail transport, paying particular attention to Nordic and European links via the East Coast routes’ with particular attention paid to the development of roll-on/roll-off facilities and the supporting infrastructures. In 2017, for example, Ireland introduced a Dublin-Zeebrugge Ro-Ro-Ro vessel MV CELINE capable of ferrying 600 trailers. This may be done by developing multimodal transport hubs, including setting up a certification programme for approving qualifying goods that meet standard specification, set down by appropriate government departments’. Such systems, although well established in other countries, require a wide range of support services including: banking, logistics, and Customs all working together with their respective regulatory agencies in order to maximise revenues at the Points of Import and Export activity.

5.1.4 Determine Prohibitions & Restrictions

These to be determined and enforced under Scots Law. Normally, such contraband will include: weapons, explosives, illegal drugs and counterfeit goods. This paper strongly recommends that Customs Service’s primary role should be confined to Revenue Collections. Accordingly, officers should be trained to identify P&R but protocols should require such contraband to be immediately handed over to a relevant agency such as Police Scotland or the appropriate Military Authority.

5.1.5 Incorporate Northern Sea Route (NSR)

Scotland is strategically placed to benefit from any expansion of trade along the North Sea Route emanating along the arctic coast of Russia. “This is the maritime route that is likely to be free of ice first and thus represents the highest commercial potential. It would reduce the maritime journey between East Asia and Western Europe from 21,000 km using the Suez Canal to 12,800 km, cutting transit time by 10-15 days” The Scottish Government must anticipate attracting sea-trade from this route in order to maximise revenues.

5.2 Revenues

5.2.1 Large Trader Control Units

Establish regional Large Trader Control Units (LTCU’s) to identify corporate and major traders. These specialist multi-discipline teams (VAT, Excise, Customs, and Income Tax etc.) identify local Traders using Trade Classifications and Annual Turnover. LTCU thresholds and revenues targets should be determined at a “Strategic” level

5.2.2 Addressing the Tax Gap

The Sustainable Growth Commission suggest that Scotland faces a £36B ‘tax gap’ (the difference between the quantities of tax that should, in theory, be collected, against what is actually collected).” Prof Murphy (2014), suggests that the correct figure is closer to £120B. Irrespective of which of these numbers is closer to the truth, this is a national scandal that has been allowed to go unchecked by successive Westminster Administrations. An Independent Scotland revenue strategy will need to quickly and decisively address ways of significantly reducing this gap. If not, it will have a very negative effect on the range and quality of public services the Holyrood Government can provide. This would require a well-resourced enforcement campaign to ensure tax compliance.

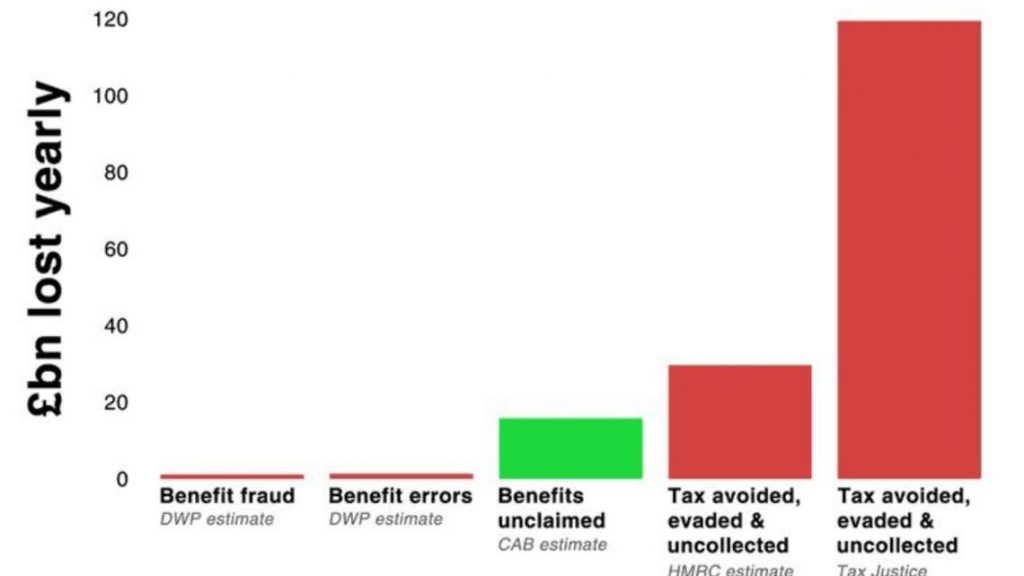

An informative footnote: £120B is the estimated UK figure for 2014 but £90B is the 2019 estimate. We would argue that the “Tax Gap” will regress towards the scandalously high 2014 figure as a result of the post-covid and Brexit economic damage. Furthermore, anecdotally, DWP has approximately 2,000 Investigators dealing with low-level fraud in comparison to only 200 HMRC Investigators dealing with massive revenue frauds (see figure 2).

Figure 2 Fraud estimates

5.2.3 Monitoring Shipping Traffic

Generally, this is identified as: General Cargo, Dry Bulk, Liquid Bulk and Unitised Freight (shipping containers) with large volumes of traffic entering and leaving Scottish waters every day. Irrespective of whether Scotland is a member of the EFTA or EU trading blocs, significant traffic and associated revenues will be generated by this trade. To this end, specialised Mobile Rummage Crews (MRCs), trained in searching for hidden contraband such as illegal substances or people smuggling activities, must be recruited, trained and posted at key ports of entry to monitor and control shipping entering and leaving Scottish waters.

5.2.4 Enforce VAT & Excise Audits

Regular tax field audits must be reinstated and co-ordinated with import/export controls. Anecdotally, black economy “cash” traders have not been controlled since 2005. It is essential to establish trading norms in order to identify risk.

5.2.5 Revenue from rUK Export Energy Charges

“In 2017, the energy sector accounted for 11.7 per cent (£3.8bn) of Scotland’s international exports and 15.9 per cent (£7.8bn) of Scotland’s exports to the rest of the UK. International exports and exports to the rest of the UK have grown significantly since 2002” Consideration must be given to raising revenues from this resource.

5.2.6 Revenue from Air Traffic

Notwithstanding “green” issues, air cargo will continue to be at an extremely high volume and therefore, important as a high revenue source.

5.2.7 Revenue from Road Traffic

Freedom of movement of people and goods must be agreed with the other regions of the UK. Placing an emphasis on post-import inland controls, located at the trader’s premises or authorised Inland Clearance Depots (ICDs) must be the norm. Multi-Agency exercises combining: transport authorities, police, trading standards and Customs, should periodically be carried out within our designated jurisdiction. Ideally, as set out in the EU “Intelligent Transport Systems Directive”, at multi-agency inspection facilities, on the M74, M8 and main road transport routes. Utilisation of existing technologies, such as Automated Traffic Counters, used by Transport Scotland, can be enhanced with Customs intelligence systems.

Seizure of vehicles carrying contraband is an excellent deterrent to criminal activity. Note also, appropriate seized vehicles (plus vessels and aircraft) may be utilised and taken into Customs service.

5.2.8 Revenue from Rail Traffic

Coatbridge Freightliner Terminal is one of the well-established areas for multi-agency inspections and control joint working but consideration must be given to other railheads across Scotland, such as, at the new roll-on, roll-off facility at Nigg Bay or at Aberdeen. Again, post-import inland controls must be the norm.

5.2.9 Enforcement

National Freight Intelligence Unit (NFIU)

It is essential for Scotland to re-establishes such a multi-agency team, within the National Crime Agency, to facilitate and support the National Risk Assessment and Analysis initiatives, both for Revenue collections and Impoundment of Prohibited and Restricted goods.

Mobile Task Forces (MTF)

These specialist regional teams can, if needed, augment permanently stationed Customs, air and sea stations.

6 Defence

The Scottish Government can consider closure of its borders but only in a National Emergency and as directed by the Government. In such circumstances, Customs Services engage in different control/security standpoints from its open, light-touch EU normality. Clearly, the current COVID pandemic is an example of such.

6.1 National Defence Academy (NDA)

Potentially, an NDA could be the Scots defence “Jewel in the Crown”. What would it be for? The elected Scots government would utilise the residential NDA, including Customs, in its collective defence strategy. NDA should facilitate post-graduate research in defence and Customs matters

The established PICARD programme (Partnership in Customs Academic Research & Development) promotes Customs professionalism and academic research through the International Network of Customs Universities (INCU).No Scots academic institutions currently take part in this programme however, this report recommends Scotland’s National Defence Agency should become a member.

Middle and senior ranking service officers, such as Police and Customs etc. should all be coordinated under a single protocol when it comes to building a multi-agency defence strategy. Denmark currently has a similar system.

The purpose of the National Defence Agency is generally understood “to provide the People of Scotland with the best up-to-date defence capabilities and collectively develop a successful, credible, effective, and flexible defence strategy to protect our Common Weal and allies”. Overall responsibility of the National Defence Agency would most likely lie with the Defence Minister who would also be responsible for carrying out Defence Reviews.

The National Defence Agency should be influential in coordinating a coherent Scots defence strategy; developing plans to identify and overcome the risks and threats to Scotland’s security; informing planning at a strategic level.”

Threat Analysis must identify air, maritime, cyber and biological warfare as current threats. A Customs service, and their maritime and air assets, must be integrated into our Defence Strategy, as they are with Australia and Norway, for example.

6.2 Maritime Defence

‘In considering the defence model for an independent Scotland, military planners must give priority to patrolling and defending Scotland’s long coastline, her territorial waters, exclusive marine economic zone and airspace.’This quote from a military source highlights how the emphasis must always be on the protection of Scotland’s people and her national resources. Such a commitment requires an effective Navy, Air Force, Coast Guard and Customs service with efforts principally directed towards: aerial and maritime patrol, surveillance, search and rescue, environmental monitoring, fisheries protection and shipping safety.

There is much to commend the wisdom of this approach. Scotland is pre-eminently a maritime nation whose territorial waters are more than five times larger than its land mass. It has over 11,000 km of highly indented coastline, accounting for approximately 61% of the total UK coastline, and over 800 islands. Scotland’s territorial waters, together with her Exclusive Economic Zone as set by the 1982 Convention on the Law of the Sea, extend 200 nautical miles outwards from the coast. The waters within this boundary constitute Scotland’s recognised fishing limits; a total sea area of 468, 994 square km. By contrast, relatively narrow bodies of water – the English Channel and the North Channel in the Irish Sea, are all that separate Scotland from continental Europe and Ireland respectively. Scotland’s physical characteristics and location confer many benefits but they are also a risk and a newly independent Scotland should look to develop its defence model around those risks. Precisely what should be prioritised – and why.

6.3 Regional Cooperation

No single Customs Service/jurisdiction can operate effectively in isolation, therefore, regional cooperation is essential. This must be achieved from government strategic levels to operational/tactical level through regular training exercises and establishment of Liaison Officers.Important issues include:

- Harmonisation of taxation across both jurisdictions removes the incentive to smuggle as funding for criminality, irrespective of south to north or vice-versa. It also reduces the requirement for border controls.

- EU & EFTA “Hard Border”. EU accession requires compliance with Customs requirements within EU Acquis. There is zero mention, nor requirement, for “Hard Border” within Acquis.

- EU Acquis is specific about what is required of an aspiring EU member, but is not proscriptive about the “how”. This is left to the individual EU member to ensure compliance, with or without border controls.

6.4 Brexit

Clearly, whether Scotland becomes a member of the EU or EFTA, our economy and Customs Service would be hamstrung. Key issues include:

6.5 Lost EU protection

This is vital for our brands such as Scotch whisky, Scottish salmon and so forth. The Transatlantic Trade & Investment Partnership (TTIP) largely failed because the EU did not accept American demands. The UK can now expect to subjugate itself to a similar TTIP demand, in order to benefit USA corporations.

6.6 EU control of markets

Markets left to themselves become the private property of cartels. If we did not have the likes of Margrethe Vestager and the EU Commission we would need something like it to have the collective clout to say No to the corporations. This includes ensuring payment of Customs revenues and taxes. The EU attempts to ensure fair market rules for everyone with fair revenues in order to encourage competition. Competition is essential for innovation, customers and the economy.

“Soft Border for Ireland but not for Scotland.” Ireland gets a vote on any Brexit deal as an EU member, potentially blocking any deal that is bad for them. Scotland, under London Rule, has no such power.

6.7 Relationship with Northern Ireland.

The claims that Boris Johnson does not understand the Brexit withdrawal agreement can be questioned.A careful examination of his words suggest he is not claiming his deal does not specify any checks between Northern Ireland and the mainland. What he is stating is his assurance that there will be no checks enforced. This confirms fears that Boris Johnson simply has no intention of actually implementing the withdrawal agreement. This would fit with his broader approach to governance as described by Craig Murray ‘He has no moral scruples over lying, it is not his style to think beyond immediate personal advantage, and he is still enamoured of the idea that in the end the EU will always buckle because it needs the UK market.”

6.8 Anti-Fraud cooperation

A Scots Customs Service would lose out on access to major organisations such as the EU Anti-Fraud Office down to simple, essential checks on such as EU Vehicle Registration Numbers (VRNs).

7 Summary

Manufacturing growth and exports are crucial to Scotland’s economic success. Scotland continues to have a trade surplus in contrast to England’s consistent trade deficit. Scotland’s exports are intrinsically linked to EU trade with 41% of our overall food and drinks exports going to the EU that would continue whether we are members of the EFTA or EU. Scottish waters produce 20% of the EU’s seafood catch, which amounts to 62% of all seafood landed in the UK, two thirds of which are exported to the EU.Allocation of Customs resources should be prioritised to simplification and enactment of Customs export legislation in order to support our economy.

At this point, this paper refers back to HM Customs & Excise and strongly recommends the re-creation of a Customs Service. Why? VAT, Customs and Excise duties (amongst others) are not just collected at borders import but especially inland, too. Logic, and good governance, suggest an integrated revenue department would be far more effective in collection and protection of our national revenues. Inter-discipline coordination of revenues strategy, policy and staffing is the key to success (see below). Compare and contrast to UK misgovernment with competing priorities between separate Home Office and HM Treasury.

A report for Commonweal clearly sets out options for how we organise our customs services and borders.This is important not just for our security, but also to tackle smuggling, counterfeit goods and for revenue collection.It is also important to control illegal exports, such as arms and military style arrest equipment to pariah regimes across the world.

What matters is whether we control our tax system to benefit our priorities, whilst preventing corporations running wild. We need to explain to Scotland’s electorate, but particularly No voters, the consequences to their day-to-day lives of the catastrophic Brexit fraud concurrent with demonstrable evidence of how to protect our society through Independence within the EU – arguably through EFTA membership.

Scotland’s Communities and society need to trust that our nascent revenue regime is fair for all – which it won’t be in post-Brexit UK. Clearly, that trust has to be earned with encouragement and education towards tax compliance.

In 2005, Gordon Brown carried out economic vandalism by disappearing an integrated, multi-tax regime (including borders) in HM Customs & Excise on behalf of his business elite cronies. Well, Scotland will need a professional Customs Service to carry out its facilitation of our traders, normal tax collection roles and also its law enforcement responsibilities. We need our whole society to trust the integrity of our transitional borders/revenues system will actually benefit our communities. The current UK system is corrupt.

On 12 June 20, the Westminster government admitted there will be a six months import cargo “honesty-box” system, from the EU, between Brexit on 1 Jan 21 and 30 June 21. The UK can confidently anticipate a smuggling tsunami. HMG Revenues losses will be astronomical.

Democracy through active participation builds trust and solidarity. Trust is not built through exclusion and xenophobia. This is the strongest argument for open EU cross-border co-operation, not Brexit alienation and xenophobia.

In summary, we have a golden opportunity on the horizon for our society and economy to be a happier, fairer place to live and work which can be demonstrated through real distribution of wealth by robust revenues reform. Scotland must seize the hour. But there will be very little point in bringing about independence if all we do is swap a London elite for an Edinburgh one.

The author looks forward to developing these themes within this SIC initiative.

Bill

WJ AUSTIN